GENERAL INFORMATION

Cephei Capital Management (Hong Kong) Limited (“Cephei Capital” or the "Company") has a fiduciary responsibility to maximize investment returns for our clients consistent with the investment objectives specified, including the voting of proxies. Our primary objective is to maximize shareholder value and to vote in a manner that reflects the best interest of our clients.

Cephei Capital has systematically incorporated ESG factors into the investment analysis and decision-making processes and considers proxy voting as an important way of demonstrating our views and expectations to our portfolio companies. Our investment team makes best efforts to exercise proxy voting rights on management and shareholders' resolutions for Cephei Capital managed Funds and the Segregated Management Accounts with specific arrangements.

PROXY VOTING STATEMENT

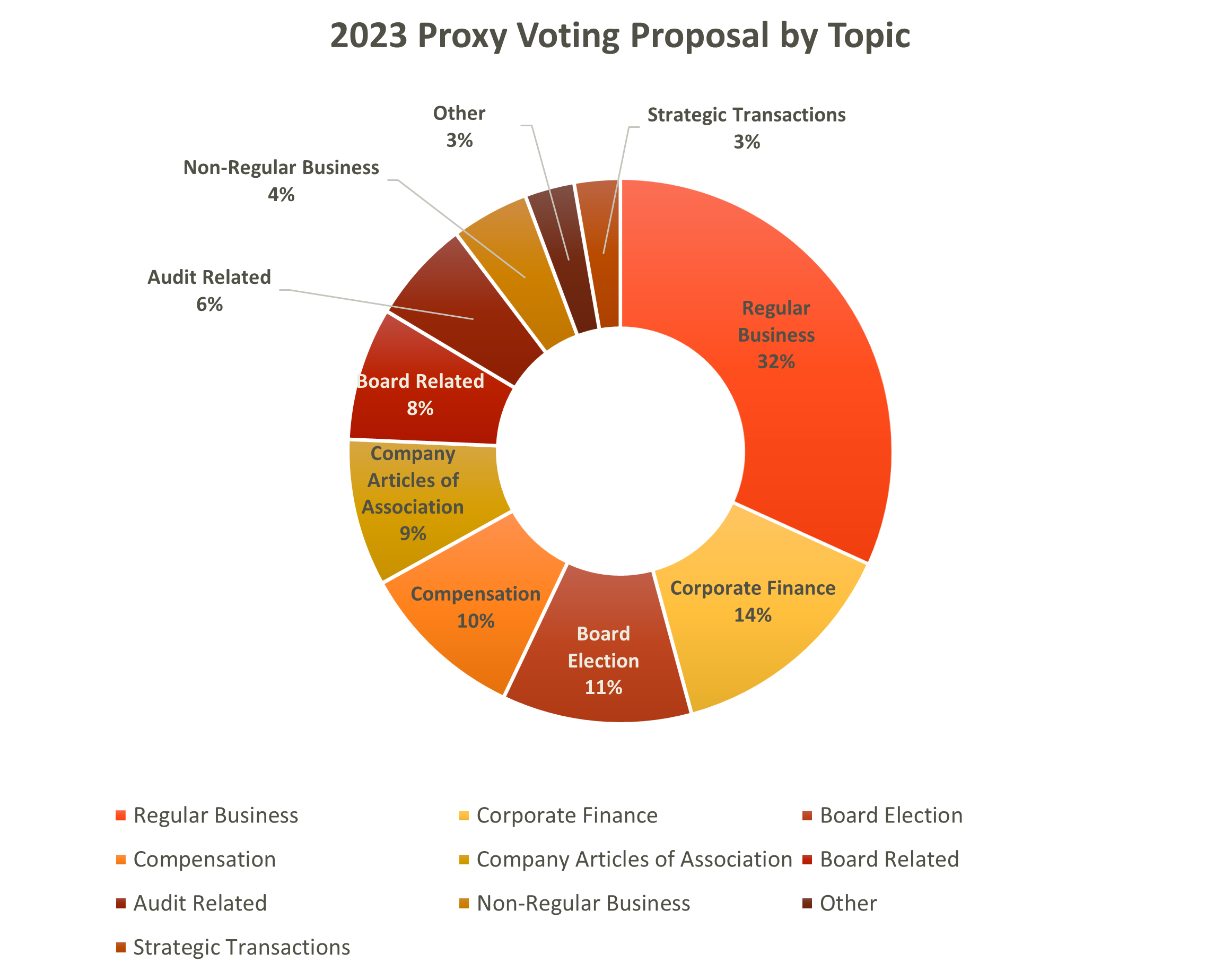

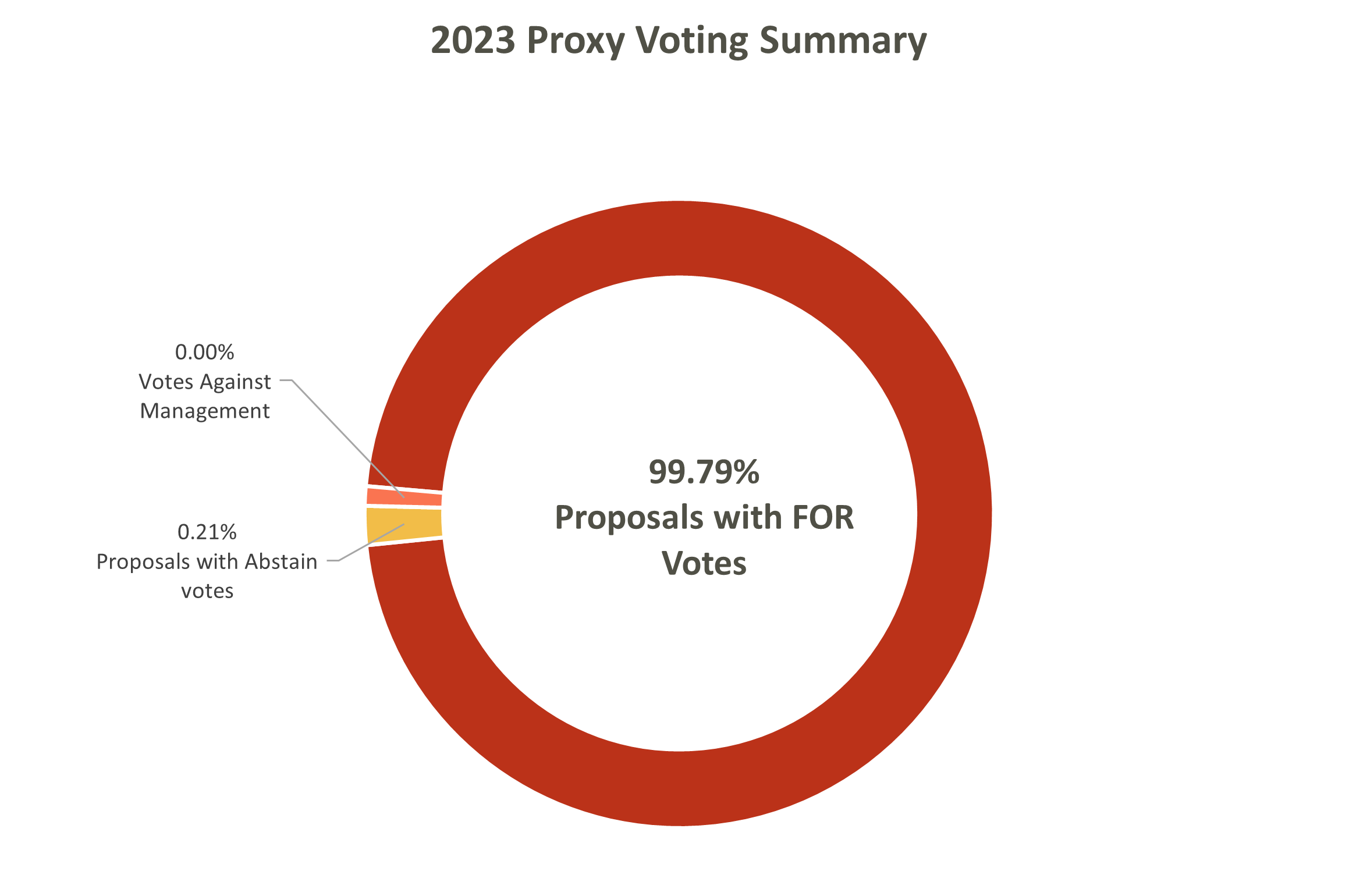

Cephei Capital voted on 141 meetings and 950 proposals in 2023, of which Cephei Capital abstained on two proposals at one meeting and voted in favor of the rest. The top five categories of proposals were Regular Business (31.79%), Corporate Finance (14.00%), Board Election (11.26%), Compensation (9.89%), and Company Articles of Association (8.74%).

Cephei Capital places significant emphasis on ESG factors during the portfolio management process. Cephei Capital believes that integrating ESG into our investment management framework is not only essential from a social responsibility perspective, but also an effective way to enhance our investment performance over the long run.

Source from: Cephei Capital voting report

GENERAL INFORMATION

Cephei Capital Management (Hong Kong) Limited (“Cephei Capital” or the "Company") has a fiduciary responsibility to maximize investment returns for our clients consistent with the investment objectives specified, including the voting of proxies. Our primary objective is to maximize shareholder value and to vote in a manner that reflects the best interest of our clients.

Cephei Capital has systematically incorporated ESG factors into the investment analysis and decision-making processes and considers proxy voting as an important way of demonstrating our views and expectations to our portfolio companies. Our investment team makes best efforts to exercise proxy voting rights on management and shareholders' resolutions for Cephei Capital managed Funds and the Segregated Management Accounts with specific arrangements.

PROXY VOTING STATEMENT

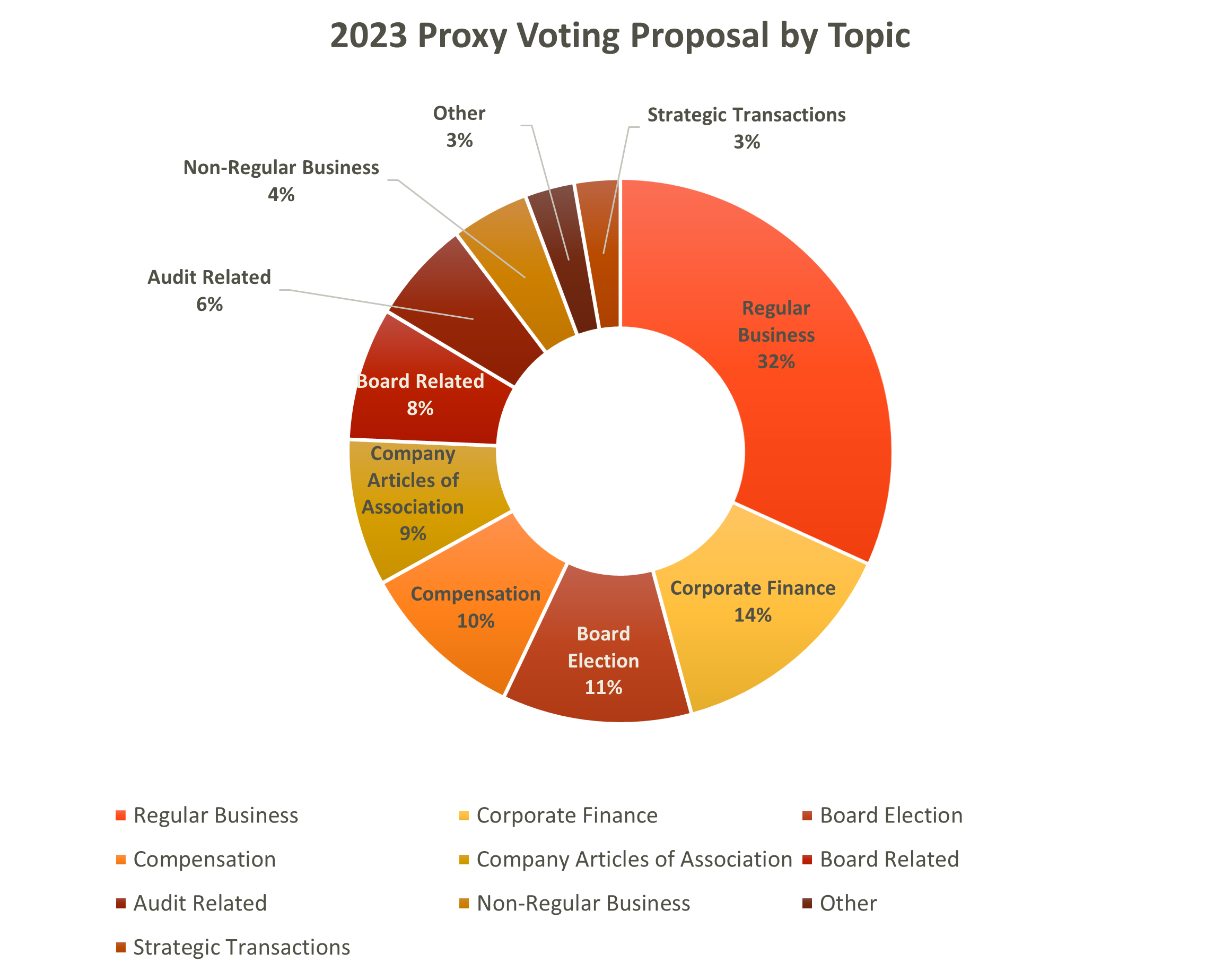

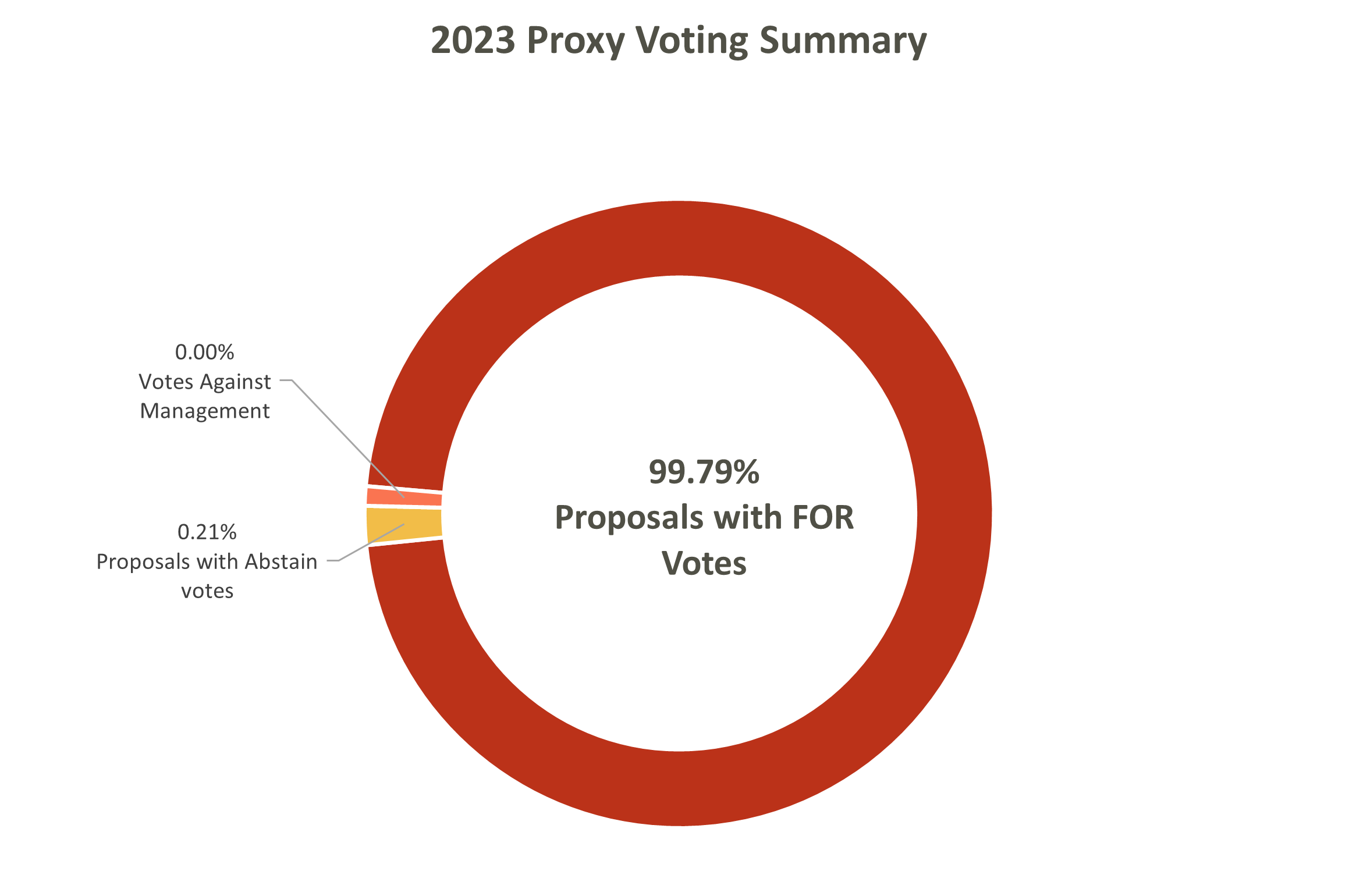

Cephei Capital voted on 141 meetings and 950 proposals in 2023, of which Cephei Capital abstained on two proposals at one meeting and voted in favor of the rest. The top five categories of proposals were Regular Business (31.79%), Corporate Finance (14.00%), Board Election (11.26%), Compensation (9.89%), and Company Articles of Association (8.74%).

Cephei Capital places significant emphasis on ESG factors during the portfolio management process. Cephei Capital believes that integrating ESG into our investment management framework is not only essential from a social responsibility perspective, but also an effective way to enhance our investment performance over the long run.

Source from: Cephei Capital voting report