90+

40+

"VGC" is the organic combination of Venture & Growth Capital. VC+Growth give full play to their respective advantages. On one hand, we examine the project's growth potential from a VC perspective and analyze how it leads the industry trends. On the other, we assess the project’s from a Growth investor’s perspective, with in-depth research into market trends and business fundamentals, to create excess returns under mitigated risk exposure.

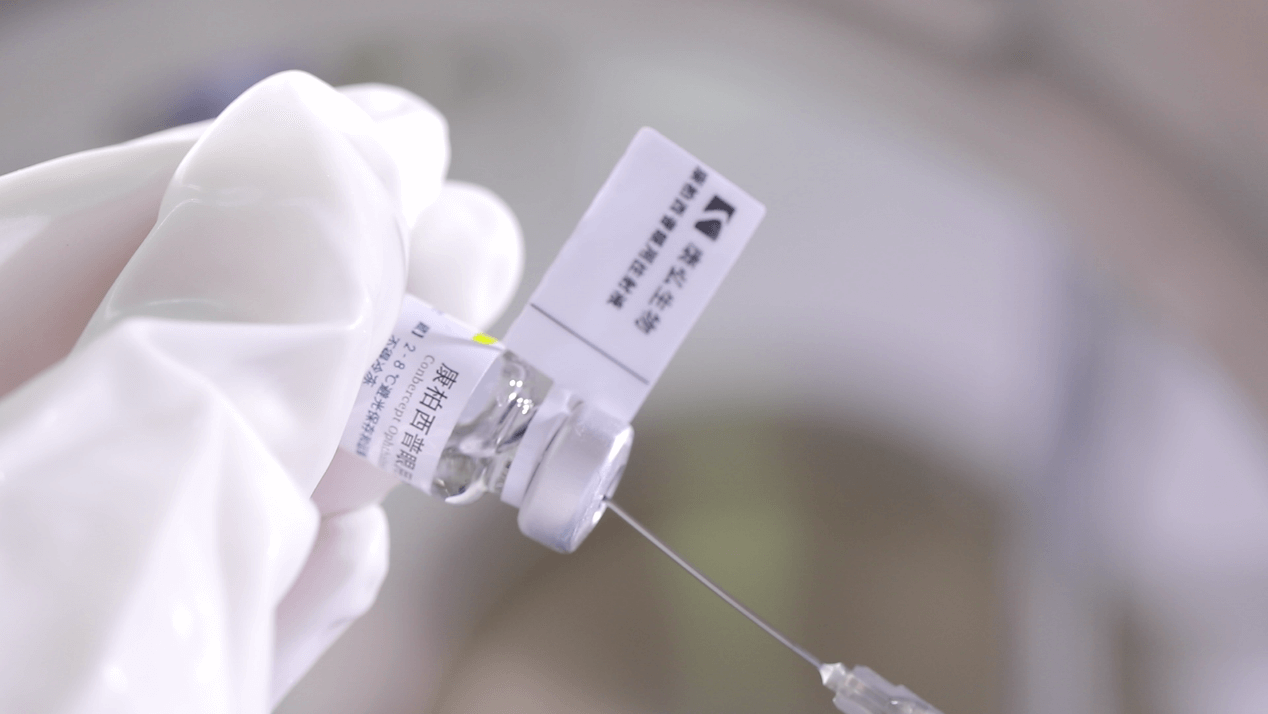

CDH VGC was founded in 2015. With the mission to invest in technological innovation to drive value creation with social impact, VGC has invested in ~90 innovative industry leaders in healthcare, artificial intelligence & technology, consumer, and enterprise solution. We are committed to discovering technological innovations that address major challenges and improve well-being in our societies.

We have always been committed to discovering entrepreneurs with great vision. These entrepreneurs develop ambitious vision from their decades of sector expertise: to achieve greater goals beyond creating a successful business platform, such as driving industry evolutions and even making positive social impacts.

90+

40+

"VGC" is the organic combination of Venture & Growth Capital. VC+Growth give full play to their respective advantages. On one hand, we examine the project's growth potential from a VC perspective and analyze how it leads the industry trends. On the other, we assess the project’s from a Growth investor’s perspective, with in-depth research into market trends and business fundamentals, to create excess returns under mitigated risk exposure.

CDH VGC was founded in 2015. With the mission to invest in technological innovation to drive value creation with social impact, VGC has invested in ~90 innovative industry leaders in healthcare, artificial intelligence & technology, consumer, and enterprise solution. We are committed to discovering technological innovations that address major challenges and improve well-being in our societies.

We have always been committed to discovering entrepreneurs with great vision. These entrepreneurs develop ambitious vision from their decades of sector expertise: to achieve greater goals beyond creating a successful business platform, such as driving industry evolutions and even making positive social impacts.